All Categories

Featured

Table of Contents

Term Life Insurance Policy is a type of life insurance policy that covers the insurance holder for a specific amount of time, which is understood as the term. The term sizes vary according to what the specific picks. Terms commonly vary from 10 to 30 years and boost in 5-year increments, supplying level term insurance.

They usually give an amount of coverage for a lot less than irreversible sorts of life insurance. Like any plan, term life insurance policy has advantages and disadvantages relying on what will work best for you. The benefits of term life consist of price and the ability to customize your term size and protection amount based upon your demands.

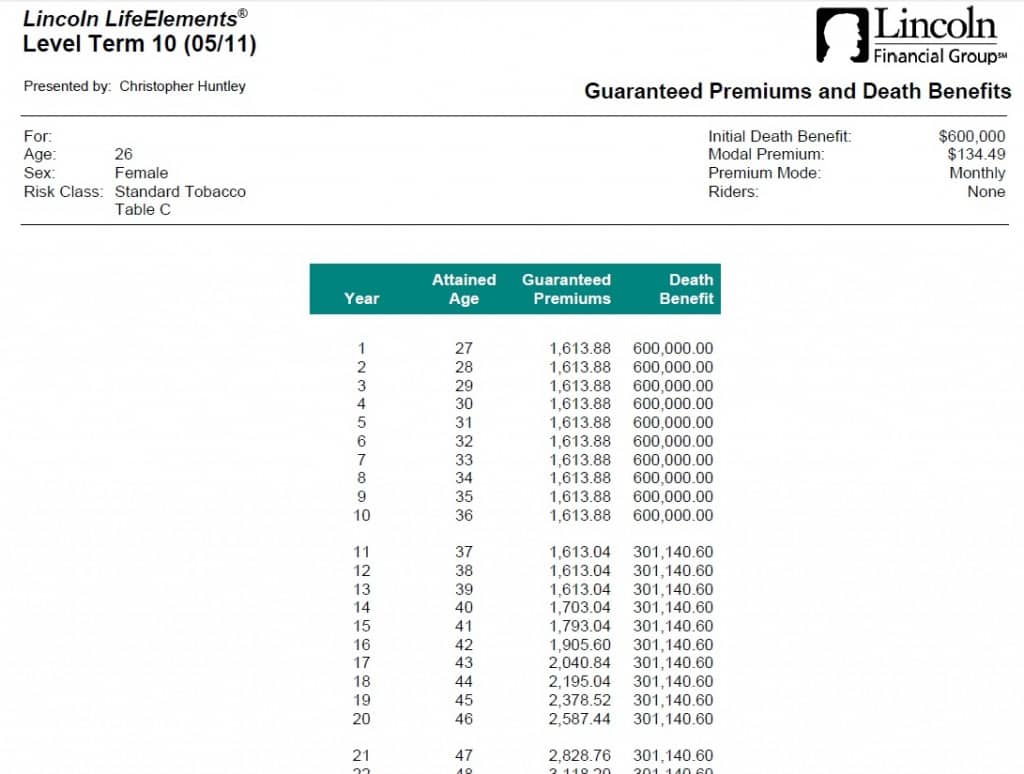

Depending on the kind of plan, term life can provide dealt with premiums for the entire term or life insurance policy on level terms. The death advantages can be taken care of.

You should consult your tax consultants for your specific accurate situation. *** Fees show policies in the Preferred Plus Price Class concerns by American General 5 Stars My agent was very experienced and helpful in the procedure. No stress to get and the process fasted. July 13, 2023 5 Stars I was satisfied that all my requirements were fulfilled without delay and expertly by all the agents I talked to.

Understanding the Benefits of Level Term Life Insurance

All documents was electronically completed with accessibility to downloading and install for individual data maintenance. June 19, 2023 The endorsements/testimonials presented should not be interpreted as a recommendation to buy, or a sign of the value of any type of product and services. The testimonies are actual Corebridge Direct clients who are not affiliated with Corebridge Direct and were not provided compensation.

There are numerous sorts of term life insurance policy policies. Rather than covering you for your whole lifespan like entire life or universal life plans, term life insurance policy only covers you for a marked period of time. Policy terms usually vary from 10 to thirty years, although much shorter and longer terms may be readily available.

If you want to keep coverage, a life insurance provider might supply you the choice to restore the plan for an additional term. If you included a return of premium cyclist to your policy, you would certainly obtain some or all of the money you paid in premiums if you have outlived your term.

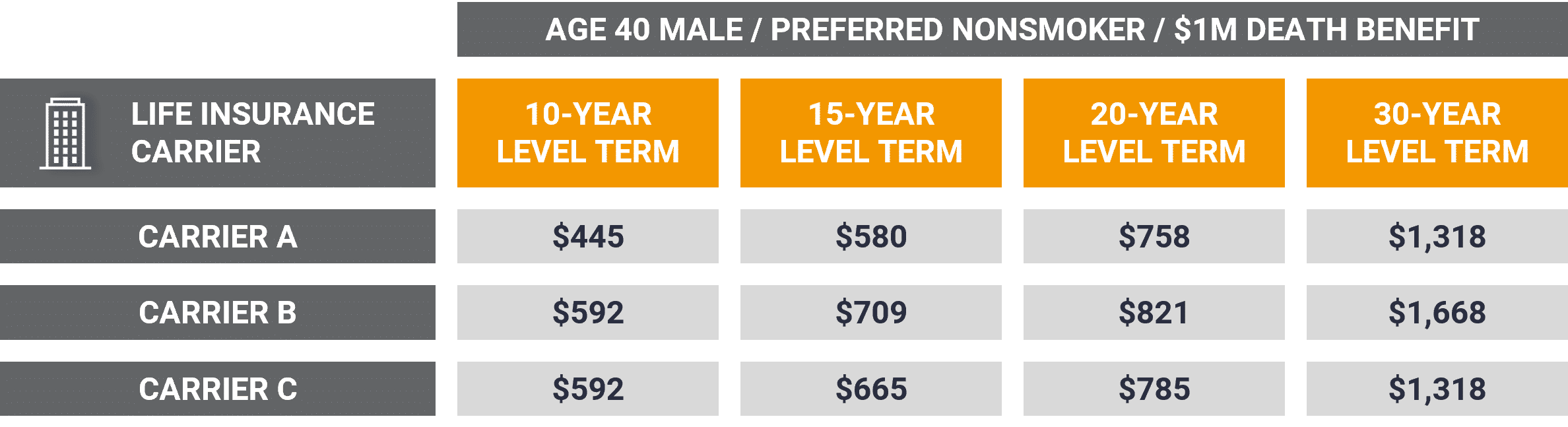

Level term life insurance policy may be the best choice for those who want coverage for a collection amount of time and want their costs to stay stable over the term. This may relate to buyers worried concerning the price of life insurance coverage and those who do not desire to change their fatality advantage.

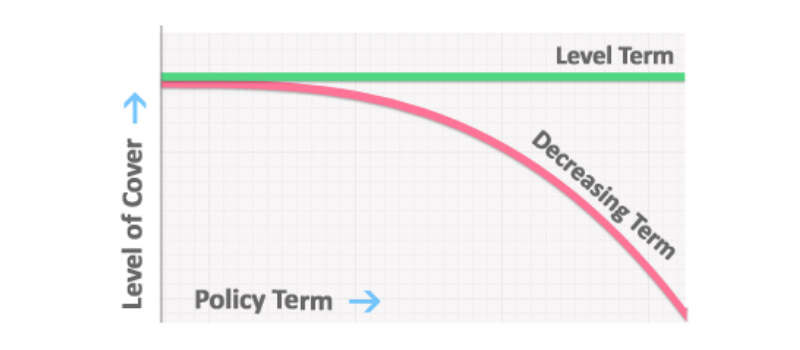

That is because term policies are not guaranteed to pay, while irreversible plans are, offered all costs are paid. Degree term life insurance is normally much more pricey than decreasing term life insurance policy, where the survivor benefit reduces gradually. Besides the type of plan you have, there are several other factors that assist establish the cost of life insurance: Older applicants generally have a greater death threat, so they are usually extra costly to insure.

On the other side, you may have the ability to protect a less costly life insurance coverage price if you open up the policy when you're more youthful. Comparable to innovative age, inadequate health and wellness can likewise make you a riskier (and much more pricey) prospect for life insurance. Nonetheless, if the condition is well-managed, you may still be able to find affordable insurance coverage.

What is Direct Term Life Insurance Meaning? A Simple Breakdown

Nevertheless, health and wellness and age are generally much more impactful costs aspects than sex. High-risk leisure activities, like scuba diving and skydiving, might lead you to pay even more permanently insurance. Likewise, risky tasks, like home window cleansing or tree cutting, may also increase your expense of life insurance policy. The ideal life insurance coverage firm and plan will depend on the person looking, their individual score variables and what they require from their plan.

The first step is to determine what you require the plan for and what your spending plan is. Some business provide on-line quoting for life insurance coverage, but numerous need you to get in touch with a representative over the phone or in person.

1Term life insurance policy offers short-lived security for an important period of time and is generally cheaper than irreversible life insurance policy. 2Term conversion guidelines and limitations, such as timing, may apply; for instance, there may be a ten-year conversion advantage for some products and a five-year conversion privilege for others.

3Rider Insured's Paid-Up Insurance Acquisition Alternative in New York. There is an expense to exercise this cyclist. Not all participating plan proprietors are qualified for dividends.

Our term life alternatives consist of 10, 15, 20, 25, 30, 35, and 40-year policies. One of the most preferred type is level term, suggesting your payment (costs) and payment (fatality benefit) stays degree, or the very same, up until the end of the term period. Level term life insurance policy. This is the most uncomplicated of life insurance coverage options and requires really little upkeep for policy proprietors

For instance, you might offer 50% to your spouse and split the remainder among your adult youngsters, a moms and dad, a close friend, or perhaps a charity. * In some circumstances the fatality advantage might not be tax-free, discover when life insurance coverage is taxable.

What is a Level Premium Term Life Insurance Policies Policy?

There is no payment if the plan expires prior to your death or you live past the policy term. You may be able to renew a term policy at expiry, however the costs will be recalculated based on your age at the time of revival.

At age 50, the costs would rise to $67 a month. Term Life Insurance Policy Rates 30 years old $18 $15 40 years of ages $28 $23 half a century old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and females in superb health and wellness. In comparison, here's a look at prices for a $100,000 whole life plan (which is a type of long-term policy, indicating it lasts your life time and includes money worth).

Passion rates, the financials of the insurance company, and state laws can additionally influence costs. When you think about the amount of insurance coverage you can get for your costs bucks, term life insurance coverage tends to be the least pricey life insurance policy.

Latest Posts

Universal Life Insurance Quotes Online Instant

Fidelity Life Final Expense

Funeral Cover Online Quote